Discover how foreign investors can buy property in Malaysia. Learn about legal rules, top cities like Kuala Lumpur and Penang, minimum price thresholds, taxes, and successful foreign developers shaping Malaysia’s real estate market in 2025.

Discover how foreign investors can buy property in Malaysia. Learn about legal rules, top cities like Kuala Lumpur and Penang, minimum price thresholds, taxes, and successful foreign developers shaping Malaysia’s real estate market in 2025.

As Southeast Asia’s economy continues to surge, Malaysia stands out as a rising star for foreign real estate investment. With strategic geography, a liberal property ownership framework, and affordable entry prices, Malaysia offers a compelling gateway for international investors eyeing Asia’s growing property sector.

Liberal Foreign Ownership Policies. Unlike many neighboring countries, Malaysia allows foreigners to own landed and high-rise properties (with a few restrictions). Each state sets its own minimum price threshold, typically starting from RM1 million.

Attractive Price-to-Value Ratio. Kuala Lumpur, Penang, and Johor offer modern, spacious units at prices far lower than Singapore, Hong Kong, or Bangkok. Investors get more square footage and luxury for their dollar.

Bilingual Environment and MM2H Program. English is widely spoken, and Malaysia My Second Home (MM2H) – a long-term residency program – appeals to retirees, digital nomads, and long-term investors.

Strong Infrastructure and Connectivity. With world-class highways, digital infrastructure, and major airports, Malaysia offers easy access to Asia’s key business and travel hubs.

The real estate business in Malaysia is a significant component of the country's economy, offering investment opportunities in both residential and commercial sectors. Here's a structured overview:

Residential: Includes condominiums, landed homes, serviced apartments, and affordable housing. Commercial: Office towers, retail spaces, malls, shop lots. Industrial: Warehouses, logistics hubs, factories (especially relevant due to Malaysia's manufacturing base). Hospitality & Tourism: Hotels, resorts, and serviced residences. Mixed-use Developments: Combining residential, retail, and office elements (e.g., Bukit Bintang City Centre, KL Sentral).

Kuala Lumpur (KL). The capital is a favorite for both residential and commercial investments. Key areas like Bukit Bintang, KLCC, and Bangsar attract urban professionals and expats. High-rise condos and serviced apartments dominate the market. Kuala Lumpur (KL): Luxury condos, expatriate housing, commercial hubs.

Penang. Known for its heritage charm and medical tourism, Penang is ideal for long-term living and retirement investments. Properties in George Town and Tanjung Tokong remain in high demand. Penang: Heritage tourism, tech parks, retirement homes.

Johor (Iskandar Malaysia). Bordering Singapore, Johor offers strategic value for Singaporean and regional investors. With large-scale developments like Forest City and Medini Iskandar, the region is poised for long-term growth. Johor (Iskandar Malaysia): Cross-border appeal for Singaporeans.

Langkawi and Sabah. Eco-tourism and hospitality investments are rising in scenic destinations like Langkawi and Kota Kinabalu. Foreigners are exploring villas, boutique resorts, and long-stay accommodation opportunities. Sabah & Sarawak: Growing eco-tourism and residential interest.

Residential and commercial transactions are rebounding since late 2023. Affordable Housing Demand: Strong demand under RM500,000 especially for young families. Boom in Data Centres and Industrial Parks: Driven by foreign tech investments. Sustainability & Green Buildings: Demand for ESG-compliant real estate. Foreign Buyers Returning: Especially from Singapore, China, and Hong Kong.

Foreigners can buy property, but typically with a minimum threshold (e.g., RM1 million in KL). Cannot buy Malay Reserve Land or certain low-cost housing.

Foreign investors can buy A Freehold or leasehold properties (depending on the project). Residential units, serviced apartments, and commercial properties. Cannot purchase A Bumiputera-reserved units. Low-cost housing schemes. Agricultural or Malay reserve land. State Minimum Price Thresholds at Kuala Lumpur is RM1 million. Selangor is RM2 million for landed, RM1.5 million for strata. Then Penang for RM1 million (island), RM500K (mainland) for strata. Johor is RM1 million

Investors looking for indirect exposure are turning to Malaysian REITs (such as IGB REIT, Pavilion REIT), while startups like Speedhome and RentGuard are digitizing the rental process. Developers are launching green-certified projects with wellness amenities to meet ESG expectations and lifestyle demand. With Malaysia becoming a logistics hub, demand for industrial real estate and data centers is rising.

Taxes are Stamp Duty, Real Property Gains Tax (RPGT), and Sales & Service Tax (SST) for commercial properties. Stamp Duty is 1%-4% depending on the property value. Real Property Gains Tax (RPGT)is 10% if sold within 5 years (for foreigners)

Legal and agent fees is Around 3%–5% of transaction value

The ringgit’s volatility can affect ROI when converting profits to home currency. Avoid overhyped developments; conduct due diligence on location, developer reputation, and rental demand. Understand the capital gains tax and market liquidity before committing to a short-term exit plan.

For foreign investors seeking stable, mid- to long-term property returns in Southeast Asia, Malaysia offers a strategic and cost-effective opportunity. With clear regulations, a maturing market, and strong rental potential in select urban centers, it is increasingly seen as a smart diversification play in the region.

Here are 5 successful foreign real estate investors or developers that have made a significant impact in Malaysia’s real estate landscape:

Mapletree Investments (Singapore) has capitalized on Malaysia’s growing e-commerce and manufacturing sectors by investing in logistics parks and modern warehousing. Their industrial assets are long-term, income-generating investments with major MNC tenants. Type: Industrial, Logistics & Commercial. Notable Projects: Mapletree Logistics Parks in Shah Alam and Subang. Office properties in Cyberjaya and KL.

Country Garden (China) Although controversial and slowed by policy shifts and market conditions, Forest City remains one of the largest foreign-backed real estate projects in Malaysia’s history. Country Garden also has other residential projects in Malaysia, such as Central Park and Diamond City. Type: Residential & Mixed-Use Megaproject. Notable Project: Forest City, Johor (Iskandar Malaysia). A massive $100B development on reclaimed land, designed as a smart eco-city.

Hongkong Land (Hong Kong) has investments in Malaysia, primarily through its subsidiary, MCL Land, a residential developer. MCL Land has a legacy of building homes in both Singapore and Malaysia and is part of the Jardine Matheson Group, under Hongkong Land Holdings. Notable projects include Quinn, Seri Riana, Riana Green East KL, and Wangsa Walk Mall.

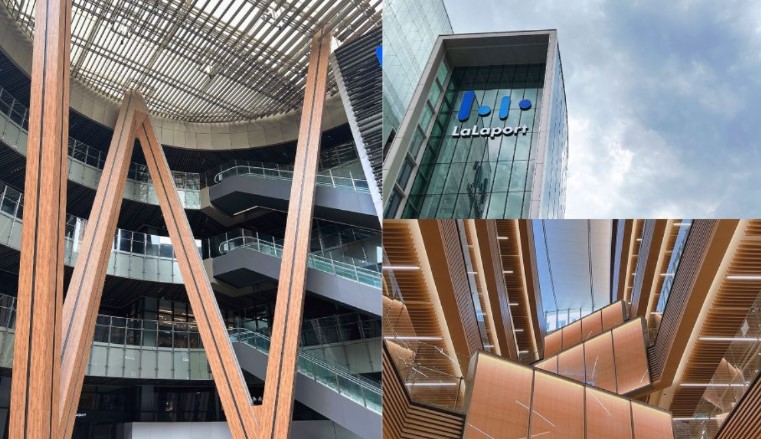

Mitsui Fudosan (Japan) brought Japan’s retail experience to KL and is part of the BBCC JV with UDA Holdings and EcoWorld. It attracts both tourists and locals with its unique positioning. Type: Retail & Commercial. Notable Project: LaLaport Bukit Bintang City Centre (BBCC), Kuala Lumpur. A flagship Japanese-style lifestyle mall and part of a major integrated urban development.

Real Estate Agencies. Reapfield, IQI Global, PropNex Malaysia, Hartamas, CBRE | WTW.

Online Portals. PropertyGuru, iProperty, EdgeProp, Mudah.my (for sub-sale).

Malaysia offers a unique blend of affordability, accessibility, and long-term growth potential for foreign real estate investors. With a relatively liberal ownership policy, strategic location in Southeast Asia, and rising demand in both residential and industrial sectors, the country remains an attractive choice. While due diligence is essential—especially regarding state regulations and project viability—the opportunities in key cities like Kuala Lumpur, Penang, and Johor are abundant. For investors seeking diversification, stable rental yields, and entry into ASEAN’s real estate market, Malaysia stands as a compelling and rewarding destination.