Discover how QRIS is transforming digital payments in Indonesia’s cities—empowering merchants, enhancing inclusion, and connecting ASEAN economies.

Discover how QRIS is transforming digital payments in Indonesia’s cities—empowering merchants, enhancing inclusion, and connecting ASEAN economies.

Indonesia's Role in QR Code Payments

While China is the pioneer in QR-based payments (with Alipay and WeChat Pay), Indonesia stands out as the regional leader in unifying QR payments under a national standard. QRIS sets it apart by ensuring that users and merchants, regardless of their chosen payment service provider, can transact using a single QR code system. This innovation has not only enhanced domestic payments but also paved the way for cross-border QR payments in Southeast Asia.

In the rapidly evolving digital landscape of Indonesia, QRIS (Quick Response Code Indonesian Standard) has emerged as a transformative force in the way people and businesses transact in urban environments. Developed by Bank Indonesia and ASPI (Asosiasi Sistem Pembayaran Indonesia), QRIS represents more than just a payment tool—it is a symbol of financial inclusion, innovation, and modernization in one of Southeast Asia's fastest-growing economies.

QRIS (Quick Response Code Indonesian Standard) was developed by Bank Indonesia (BI) and launched in 2019 to standardize QR code payment systems across all banks and fintech platforms in Indonesia. It allows seamless payments from users across various apps, such as GoPay, ShopeePay, and BRI. QRIS is an essential part of Indonesia's strategy to promote financial inclusion and digitize the economy.

Fragmented Payment Systems

Before QRIS, Indonesia’s digital payment landscape was fragmented. Each payment service provider (PSP) such as GoPay, OVO, Dana, LinkAja, and others used their own proprietary QR codes, which created confusion and inefficiencies for both merchants and consumers. A merchant accepting payments had to display multiple QR codes if they wanted to cater to different users.

Bank Indonesia recognized that without interoperability, the digital payment ecosystem would be difficult to scale and inefficient for a nation pushing toward financial inclusion and digital transformation.

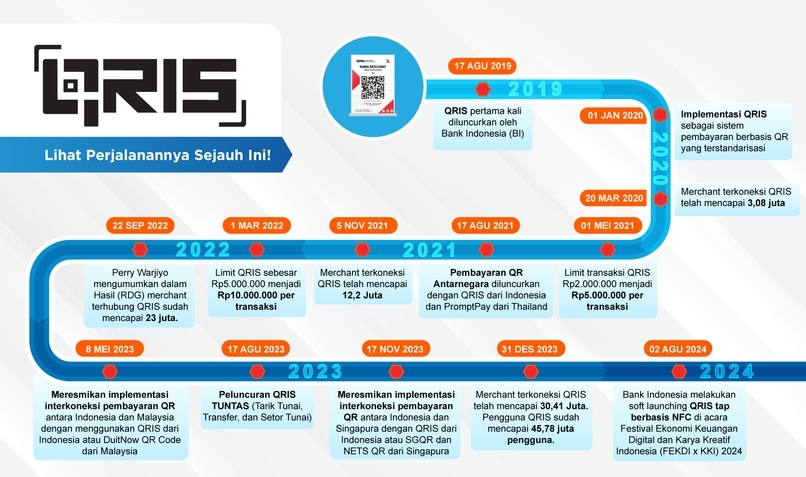

Initiation of QRIS (2018 – 2019)

Recent Developments (2022 – 2024)

Key Goals of QRIS: Boost financial inclusion by reaching the unbanked and underbanked population. Support digital transformation of MSMEs. Enhance transaction security and efficiency. Integrate ASEAN payment systems through cross-border cooperation.

QRIS (Quick Response Code Indonesian Standard) is a standardized QR code payment system developed by Bank Indonesia (BI) and the Indonesian Payment System Association (ASPI). It was launched in August 2019 to unify various QR code-based payment services into a single, interoperable system across Indonesia.

Key Features of QRIS Technology

Key Features of QRIS:

Benefits of QRIS: Reduces the need for cash. Simplifies transactions for both merchants and customers. Encourages digital financial inclusion, especially for MSMEs (micro, small, and medium enterprises). Supports data collection for better credit scoring and financial services

Let me know if you want a visual guide, infographic, or an article draft on QRIS for business or travel audiences.

In major cities like Jakarta, Surabaya, Bandung, and Denpasar, QRIS has become a daily fixture—from traditional market stalls to high-end retail outlets, cafés, and ride-hailing services. It allows consumers to pay using their preferred mobile banking app or e-wallet by simply scanning a standardized QR code.

According to Bank Indonesia, QRIS transactions surpassed 2.8 billion in 2023, a staggering growth that underscores the public’s increasing trust in digital payment solutions. Urban merchants, including small warungs, fashion boutiques, and even street performers, have adopted QRIS to streamline payment collection without relying on point-of-sale hardware.

As of mid-2024, QRIS (Quick Response Code Indonesian Standard) has reached a significant level of adoption in Indonesia, with over 50 million users and more than 33 million merchants accepting QRIS payments nationwide. This represents a massive increase in adoption—over 200% growth in transaction volume compared to the previous year.

In terms of usage, QRIS transactions are steadily replacing traditional ATM and debit card transactions. For instance, while ATM/debit usage fell by nearly 10%, QRIS usage surged, indicating that a large portion of daily financial activities—especially among small merchants and street vendors—has shifted to QR code-based payments.

Despite this progress, surveys and insights from Bank Indonesia highlight that not all segments of society have fully embraced QRIS. Some key challenges include:

Bank Indonesia targets reaching 55 million users by the end of 2024, and has also been pushing for cross-border QRIS payments, with the system now accepted in countries like Malaysia, Thailand, and Singapore, providing added convenience for travelers and regional trade.

Overall, it's fair to say that QRIS is functional and widely adopted across urban and semi-urban Indonesia, covering an estimated 80–85% of digitally active consumers and small businesses, but there's still room for improvement in rural outreach and public education to achieve nationwide inclusivity.

Technology That Bridges Financial Gaps

QRIS leverages the EMVCo QR Code standard—a globally accepted specification also used by Visa and Mastercard—ensuring seamless integration across apps and platforms. It’s backed by SNAP (Standardized Open API) for payment system interoperability and integrated with BI-FAST, Bank Indonesia’s real-time settlement infrastructure.

In 2023, QRIS Tap, which uses NFC technology, was introduced in major cities to enable contactless transactions, further enhancing the user experience in malls, transportation, and parking systems.

As of the end of 2022, more than 23.97 million merchants in Indonesia were using QRIS as their preferred payment method. The majority of these merchants fall under the Micro Business (UMi) category, especially those with an average transaction value below IDR 100,000 (around USD 6.30). In fact, approximately 70% of QRIS transactions come from small-value payments under this amount.

The widespread adoption of QRIS is driven by its integration with various e-wallets and mobile banking apps, along with the government's push to boost financial inclusion through digital payments.

Catalyst for Urban Financial Inclusion

One of QRIS’ strongest value propositions is its role in financial inclusion, especially among micro, small, and medium enterprises (MSMEs) in cities. By simplifying onboarding and removing the need for expensive hardware, QRIS empowers small merchants to participate in the digital economy. According to Kompas.com, over 30 million MSMEs in Indonesia have already embraced QRIS, with the majority concentrated in urban hubs where digital literacy and smartphone usage are higher.

As of March 2024, QRIS (Quick Response Code Indonesian Standard) has reached 48 million users in Indonesia, marking a 50% year-on-year increase. This growth has been supported by the rise in merchant adoption—32 million merchants now accept QRIS payments across the country.

In terms of social demographics, the dominant users of QRIS are Gen Z and Millennials. According to research from Pefindo Biro Kredit, 48.27% of QRIS-related credit users are Millennials, and 39.94% are Gen Z. These age groups are also the most active users of Buy Now Pay Later (BNPL) services, which are increasingly linked to QRIS-based transactions. Many QRIS users utilize it not just for daily purchases, but also for transactions in e-commerce, travel (ticket and hotel bookings), and retail stores.

This demographic trend highlights how QRIS adoption is particularly strong among digitally-savvy, mobile-first younger consumers who prefer cashless and flexible payment methods.

QRIS (Quick Response Code Indonesian Standard) has been widely integrated into Indonesia’s banking and digital payment ecosystem through strong coordination by Bank Indonesia (BI). As of early 2025, at least 15 major financial institutions and payment platforms support QRIS, including BCA, BRI, BNI, Mandiri, CIMB Niaga, Bank Mega, Permata Bank, Bank DKI, ShopeePay, GoPay, Dana, Netzme, and more. These institutions integrate QRIS into their mobile banking apps or e-wallets, allowing users to make payments simply by scanning a QR code or using the new QRIS Tap feature via NFC technology for contactless payments.

For example, BCA uses the NFC Pay feature in the myBCA app, while BRI users can activate Tap to Pay through the BRImo app. QRIS Tap also works in e-wallets like GoPay and Dana, provided the user's phone supports NFC and the app is updated. This method enables seamless, real-time transactions by tapping a phone on EDC (Electronic Data Capture) machines at merchant outlets.

The integration doesn’t stop at domestic use. QRIS is also expanding cross-border, already connected with Thailand’s payment system. This allows Indonesian users to pay at Thai merchants using their local apps and vice versa—benefiting tourism, SMEs, and international commerce.

Overall, QRIS is part of Indonesia’s larger strategy under the Blueprint Sistem Pembayaran Indonesia (BSPI) 2025, which aims to create an interconnected, cashless society by integrating fintech, banks, and international partners.

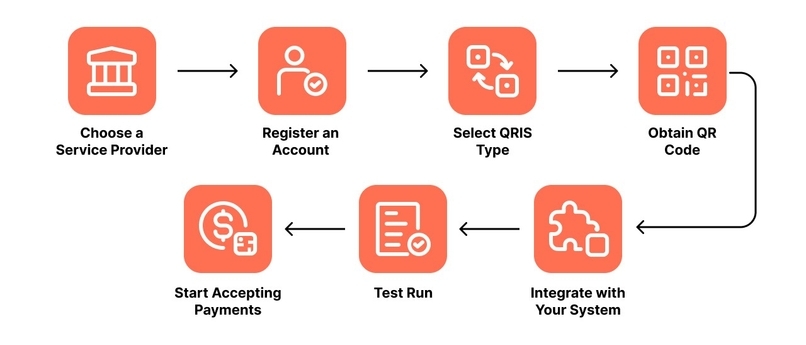

Here’s a visual-style flowchart breakdown of how QRIS integrates across major banks and fintech platforms in Indonesia, showing how users, merchants, and banks interact through the system:

QRIS Integration Flowchart

1. User: Mobile banking apps (e.g. BCA Mobile, BRImo, Livin' by Mandiri). E-wallets (e.g. GoPay, ShopeePay, Dana, OVO). Must have: Active account. Sufficient balance. Internet connection (or NFC-enabled phone for QRIS Tap)

↓

2. QRIS Scan / Tap: Static QR Code: Printed code for one merchant. Dynamic QR Code: Generated per transaction (e.g. in POS machines). QRIS Tap (NFC): Just tap your phone on an EDC terminal (if supported)

↓

3. Payment Gateway & Bank System, User's bank or e-wallet communicates with: QRIS National Clearing System by Bank Indonesia. Uses SNAP API to standardize communication across different providers. Validates: Merchant identity. Transaction amount. Fraud check.

↓

4. Merchant Bank / Wallet: Instant notification of payment. Funds settled in their merchant account (same day or next day). Merchant types: Micro businesses. Restaurants & cafes. Convenience stores. Transportation & parking. Religious & donation-based organizations

↓

5. Real-Time Settlement: Interbank transfers happen through BI-FAST or QRIS infrastructure. Daily reporting sent to both user and merchant. All transactions traceable and recorded.

QRIS is also becoming a gateway for cross-border payments. In 2023 and 2024, Bank Indonesia successfully launched QRIS interconnectivity with Malaysia, Thailand, and Singapore, allowing Indonesian tourists and urban travelers to pay abroad using local apps like GoPay, ShopeePay, or BCA Mobile.

This regional integration reinforces Indonesia’s role in leading ASEAN’s Regional Payment Connectivity (RPC) framework, designed to make cross-border retail payments cheaper, faster, and more secure. QRIS's success in Indonesia has led to its expansion into neighboring ASEAN countries, including Singapore, Malaysia, and Thailand, where it allows for cross-border payments between users and merchants in these countries. By integrating with local payment systems such as DuitNow in Malaysia and PromptPay in Thailand, QRIS enables seamless, currency-converted payments across borders.

Cross-Border Transactions

QRIS (Quick Response Code Indonesian Standard) has been expanding beyond Indonesia, and as of now, it's accepted in several countries through cross-border QR code payment agreements. These include:

These cross-border initiatives are part of a broader effort by ASEAN central banks to build Regional Payment Connectivity (RPC), enhancing financial inclusion, easing tourism-related payments, and encouraging the use of local currencies in bilateral trade

Indonesia is not the global pioneer of QR-based payments, but it is a regional leader in implementing a unified national QR code standard—QRIS (Quick Response Code Indonesian Standard). Developed and launched in August 2019 by Bank Indonesia (BI) and Asosiasi Sistem Pembayaran Indonesia (ASPI), QRIS was designed to unify all QR code payment systems across different banks and fintech platforms in the country.

Global Context:

Technology Behind QRIS:

In summary, Indonesia didn’t invent QR code payments, but it pioneered a unified national QR payment system in Southeast Asia, making it one of the most inclusive and interoperable models globally. It has also led cross-border QR payment integrations within ASEAN, setting an example for regional digital payment connectivity.

With growing adoption, QRIS is not just a payment method—it’s a strategic pillar for Indonesia’s Smart City initiatives and Digital Economy Roadmap 2025. By combining affordability, ease of use, and wide reach, QRIS is well-positioned to support Indonesia’s ambition of becoming a cashless society, particularly in urban centers where innovation meets demand.

QRIS is a testament to how technology can bridge financial gaps, digitize micro-enterprises, and transform how urban Indonesians interact with money. As Indonesia's cities continue to modernize, QRIS will remain at the forefront of the digital payment movement—making everyday transactions smarter, faster, and more inclusive. Indonesia’s implementation of QRIS has transformed the country’s digital payment landscape, providing a standardized and inclusive solution. Its technological foundation, supported by BI's infrastructure, ensures its efficiency and security. The regional QRIS cross-border initiative is expected to enhance the broader Southeast Asian financial ecosystem by promoting faster, cheaper, and more accessible digital payments across borders.

Sources: Kompas, futurecfo, seasia, twimbit, katadata, antaranews, Bank Indonesia, setkab