Malaysia business news 2026 highlights economic growth, tech and data centre investments, trade expansion, tourism recovery, manufacturing trends, and key sectors driving Malaysia’s economy in ASEAN.

Malaysia business news 2026 highlights economic growth, tech and data centre investments, trade expansion, tourism recovery, manufacturing trends, and key sectors driving Malaysia’s economy in ASEAN.

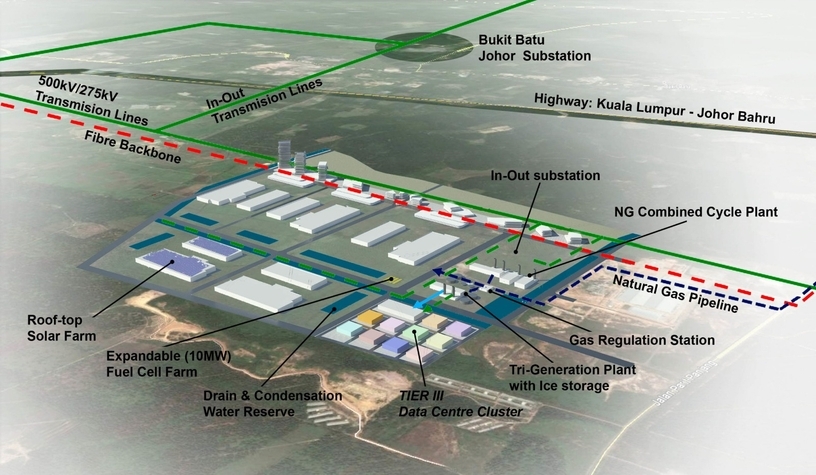

Image courtesy of ase/anup

Malaysia’s Rapid Digital Transformation

Malaysia has emerged as one of Southeast Asia’s most dynamic digital economies, driven by rapid internet penetration, smartphone adoption, and a digitally savvy population. Over the past decade, e-commerce has evolved from a niche online shopping channel into a core pillar of Malaysia’s economic growth, reshaping consumer behavior, retail, logistics, fintech, and entrepreneurship.

As digital platforms, government initiatives, and foreign investments converge, Malaysia is positioning itself as a regional digital hub, competing with Singapore, Indonesia, and Vietnam in the race for Southeast Asia’s digital economy leadership.

The digital economy in Malaysia encompasses e-commerce, digital payments, ride-hailing, online travel, food delivery, fintech, cloud services, and digital marketing. It contributes significantly to GDP, with strong growth projections driven by both domestic consumption and cross-border trade.

High internet penetration exceeding 90%. Strong smartphone usage across urban and rural areas. Government-led digitalization programs. A growing middle class with increasing disposable income. Regional integration within ASEAN’s digital market. Malaysia’s strategic location and infrastructure also make it a gateway for regional e-commerce operations.

E-commerce in Malaysia has experienced double-digit annual growth, accelerated by the COVID-19 pandemic, which permanently shifted consumer habits toward online shopping. Categories such as fashion, electronics, beauty, home appliances, and groceries dominate online sales.

Consumers increasingly prefer: Convenience and doorstep delivery. Competitive pricing and flash sales. Digital wallets and Buy Now Pay Later (BNPL) services. Livestream shopping and influencer-driven purchases.

Shopee - Shopee is the market leader, known for aggressive promotions, free shipping campaigns, and a strong presence in fashion and consumer goods. Its gamified shopping experience and livestream features have attracted millions of Malaysian users.

Lazada - Backed by Alibaba, Lazada targets more premium brands and cross-border sellers. It is strong in electronics, branded products, and logistics infrastructure through Lazada Logistics.

TikTok Shop - TikTok Shop has rapidly disrupted the market by merging entertainment with commerce. Livestream sales and influencer marketing have transformed impulse buying behavior, particularly among Gen Z and millennials.

Local Platforms

PG Mall: Malaysia’s Homegrown E-Commerce Marketplace and Its Unique Sharing Economy Model

PG Mall is a Malaysian-owned online marketplace launched in 2017 by Public Gold Group, a company originally known for gold and silver investment products. It was created to help local merchants sell products online and compete with foreign-owned platforms like Shopee and Lazada.

Unlike global marketplaces, PG Mall positions itself as a local digital commerce ecosystem, focusing on empowering Malaysian SMEs and building a community-driven shopping platform.

PG Mall is famous for its ConsuMerchant concept, a hybrid model that combines: Consumers. Merchants. Affiliates / referrers. Shoppers earn cashback (0.5%–3.5%) on purchases. Users also earn rewards when they refer new shoppers. Merchants benefit from a built-in affiliate marketing ecosystem without heavy advertising costs.

This “Shop, Share, Earn” philosophy aims to create a community-driven digital economy platform where users participate in commerce and earn income. This model differentiates PG Mall from Shopee and Lazada, which rely heavily on paid ads and subsidies.

PG Mall is considered one of Malaysia’s leading local e-commerce platforms and has achieved rapid early growth: Ranked Top 5 most visited online marketplaces in Malaysia within three years of launch. Reached over 1.6 million monthly site visits by 2020. Revenue grew 10× from RM500,000 in 2017 to RM5 million in 2018. Attracted over 10,000 merchants and more than 1 million shoppers. PG Mall was also positioned as the No.1 local Malaysian e-commerce platform in some rankings, competing with foreign platforms dominating the market.

PG Mall operates as a multi-category marketplace similar to Shopee or Lazada. Typical categories include: Electronics and gadgets. Fashion and beauty products. Home appliances and home décor. Groceries and lifestyle products. Automotive accessories. Travel and services. It targets mass-market consumers and SMEs, with strong emphasis on locally produced goods.

To scale fast, PG Mall partnered with major Malaysian ecosystem players: Logistics & Delivery; Pos Laju, DHL, GDEX, J&T Express, Skynet and EasyParcel. Payments; Boost, GrabPay, Touch ‘n Go eWallet, Maybank QR Pay and iPay88. Telecom & Marketing Partners; Maxis, Celcom, redone, iPrice and Involve Asia. These partnerships helped PG Mall improve logistics reach and digital payment adoption.

PG Mall’s vision is to bridge local Malaysian brands to global markets, promoting local SMEs internationally. The platform aims to expand across Southeast Asia and eventually global markets, aligning with Malaysia’s digital economy ambitions.

PG Mall represents Malaysia’s effort to build domestic digital platforms and reduce reliance on foreign tech giants. It supports: Local SMEs digitalization. Affiliate entrepreneurship. E-commerce participation among middle-income consumers. Malaysia’s digital economy ecosystem development.

PG Mall is a homegrown Malaysian e-commerce platform with a community-driven sharing economy model, positioning itself as a national alternative to foreign platforms. While it lacks the scale of Shopee or Lazada, it plays an important strategic role in empowering local businesses and strengthening Malaysia’s digital economy.

Mudah.my: Malaysia’s Pioneer Online Classifieds Marketplace

Mudah.my is one of Malaysia’s oldest and most influential online classified platforms, launched in 2007. It was founded by Julien Billot and Lorenzo de’ Francisci under the company OLX Malaysia Sdn Bhd, and later became part of the global OLX Group (owned by Naspers / Prosus).

The name “Mudah” means “easy” in Malay, reflecting its mission to make buying and selling second-hand goods simple and accessible for Malaysians. Unlike Shopee or Lazada, Mudah is not a full e-commerce marketplace with logistics and payments integrated. Instead, it operates more like Craigslist or Gumtree, connecting buyers and sellers directly.

Mudah operates as a C2C (consumer-to-consumer) and small business listing platform. Users can post listings for free, while sellers can pay for premium ads. Main categories include: Vehicles (cars, motorcycles). Property (rent, sale, commercial). Jobs and services. Electronics and gadgets. Furniture and household items. Fashion and personal goods. This classifieds model made Mudah extremely popular before Shopee and Lazada dominated Malaysia.

Mudah generates revenue mainly from: Paid Advertising & Premium Listings. Featured ads. Top-of-category placements. Banner advertising. Dealer & Business Subscriptions: Car dealers and property agents pay subscription packages. Businesses use Mudah as a lead-generation platform. Display Advertising: Ads from brands and agencies targeting Malaysian consumers. This high-margin digital ads model is cheaper to operate than logistics-heavy e-commerce platforms.

Before Shopee and Lazada entered Malaysia, Mudah was one of the largest online platforms for buying and selling goods. It played a major role in digitalizing Malaysia’s informal marketplace.

Even with competition, Mudah remains strong in: Automotive Listings, Car buyers and used-car dealers widely use Mudah to list vehicles. Property Listings, Landlords and agents list apartments, landed houses, and commercial property. Job Listings, SMEs use Mudah to recruit blue-collar and service workers. These verticals generate high-value leads, making Mudah attractive for advertisers.

Mudah attracts: Local Malaysians (especially middle-income users). Small traders and SMEs. Used-goods sellers. Property agents and car dealers. It is particularly strong among older internet users who are less active on Shopee/TikTok Shop.

Mobile and Desktop Usage. Mudah has: Website platform. Mobile apps (Android & iOS). However, compared to Shopee and Lazada, engagement time and transaction volume are lower because transactions happen offline. Mudah competes as a general-purpose classifieds platform, while others specialize by vertical.

Enabling the Informal Economy Online. Mudah helped millions of Malaysians monetize unused assets (cars, furniture, phones). This created a digital secondary economy long before the rise of recommerce platforms.

SME Digital Adoption. Small car dealers, property agents, and local businesses adopted Mudah as their first digital sales channel. It was one of Malaysia’s early gateways for SMEs into online commerce.

Circular Economy Impact. By promoting second-hand trading, Mudah supports: Sustainability. Waste reduction. Circular economy trends. This aligns with global ESG and green economy narratives.

Challenges and Limitations

Decline in Consumer E-commerce Traffic - Shopee, Lazada, and TikTok Shop dominate transactional e-commerce, reducing Mudah’s relevance for retail goods.

Monetization Pressure - Classifieds rely heavily on ads and subscriptions, which are less scalable than commission-based e-commerce.

Trust and Fraud Issues - Like many classifieds platforms, Mudah faces: Scammers. Fake listings. Payment fraud risks. This reduces user trust compared to escrow-based platforms.

Competition from Social Platforms - Facebook Marketplace and WhatsApp groups are free and social-driven, reducing listing demand on Mudah.

Mudah remains important because it represents: Malaysia’s early digital marketplace evolution. A transition from offline classifieds (newspapers) to online platforms. A precursor to modern e-commerce ecosystems. It is often compared to Malaysia’s version of Craigslist.

A key pillar of Malaysia’s digital economy is its robust fintech ecosystem. Cashless payments are becoming mainstream, supported by strong banking infrastructure and regulatory frameworks.

Popular Digital Wallets: Touch ’n Go eWallet. GrabPay. ShopeePay. Boost. MAE by Maybank. These wallets are widely accepted in retail stores, transportation, food outlets, and online platforms. QR code payments have become standard, supported by the national DuitNow QR system.

Buy Now Pay Later (BNPL). BNPL services are gaining popularity, allowing consumers to purchase products in installments without credit cards. This trend has expanded access to digital commerce for younger consumers and the underbanked population.

Malaysia’s government plays a significant role in accelerating digitalization through policies, grants, and infrastructure development.

Malaysia Digital (MD) Initiative. The Malaysia Digital initiative aims to transform the nation into a digitally driven economy by attracting global tech companies, nurturing startups, and upgrading digital infrastructure.

MyDIGITAL sets long-term targets for digital adoption across sectors such as education, healthcare, manufacturing, and government services. It focuses on: Expanding broadband coverage. Enhancing digital skills. Promoting e-government services. Supporting SMEs in digital transformation.

SME Digitalization Grants. The government and agencies like MDEC provide grants and training programs to help SMEs adopt e-commerce platforms, digital marketing, and cloud solutions.

Malaysia is not only a consumer market but also an emerging cross-border e-commerce exporter. Local sellers use platforms like Shopee, Lazada, Amazon, and Alibaba to sell products to Singapore, Indonesia, Thailand, and even the US and Europe.

Popular export products include: Halal food and beverages. Beauty and skincare products. Modest fashion and apparel. Handcrafted home decor and lifestyle goods. Electronics accessories. Malaysia’s strong halal certification system gives local brands a competitive advantage in Muslim-majority markets.

The digital economy has expanded into ride-hailing, food delivery, and freelance platforms. Companies like Grab, Foodpanda, and local startups have created thousands of gig jobs, reshaping employment patterns.

Malaysia is becoming a regional data center hub, attracting investments from global tech giants. Data centers support cloud services, AI applications, and digital platforms, strengthening the country’s digital infrastructure.

Influencers, content creators, and digital agencies are thriving as brands shift advertising budgets to social media, search engines, and e-commerce platforms.

E-commerce platforms engage in aggressive price wars, resulting in low profit margins for sellers. Brands must differentiate through branding, quality, and customer experience.

Logistics and Last-Mile Delivery. Delivery costs and infrastructure remain challenges, especially in East Malaysia and rural areas. Improving logistics efficiency is crucial for nationwide e-commerce growth.

Digital Skills Gap. There is a shortage of skilled professionals in AI, data analytics, cybersecurity, and software development. Bridging this gap is essential to sustain digital economy expansion.

Cybersecurity and Data Privacy. As digital transactions increase, cybersecurity risks and data breaches become major concerns. Strengthening regulatory frameworks and consumer awareness is critical.

Malaysia’s digital economy is expected to continue expanding, driven by: 5G deployment and smart city initiatives. Artificial intelligence and automation in retail and manufacturing. Expansion of fintech and digital banking licenses. Regional e-commerce integration within ASEAN. Growth of halal digital marketplaces. The country’s ambition to become a high-income digital nation by 2030 positions e-commerce and digital services as key growth engines.

E-commerce and the digital economy are transforming Malaysia’s business landscape, consumer behavior, and employment structure. With strong government support, advanced digital infrastructure, and a tech-savvy population, Malaysia is poised to become one of Southeast Asia’s leading digital economies.

For businesses, entrepreneurs, and investors, Malaysia offers vast opportunities in online retail, fintech, logistics, digital marketing, and cross-border trade. Companies that embrace digital transformation, data-driven strategies, and customer-centric innovation will be best positioned to thrive in Malaysia’s rapidly evolving digital ecosystem.